White Oil Price In China

- China : 1148 USD/MT

In the fourth quarter of 2023, the price of white oil in the Chinese market reached 1148 USD/MT. While crude oil prices declined, white oil prices in the region showed limited changes due to a balanced gap between existing demand and current supplies.

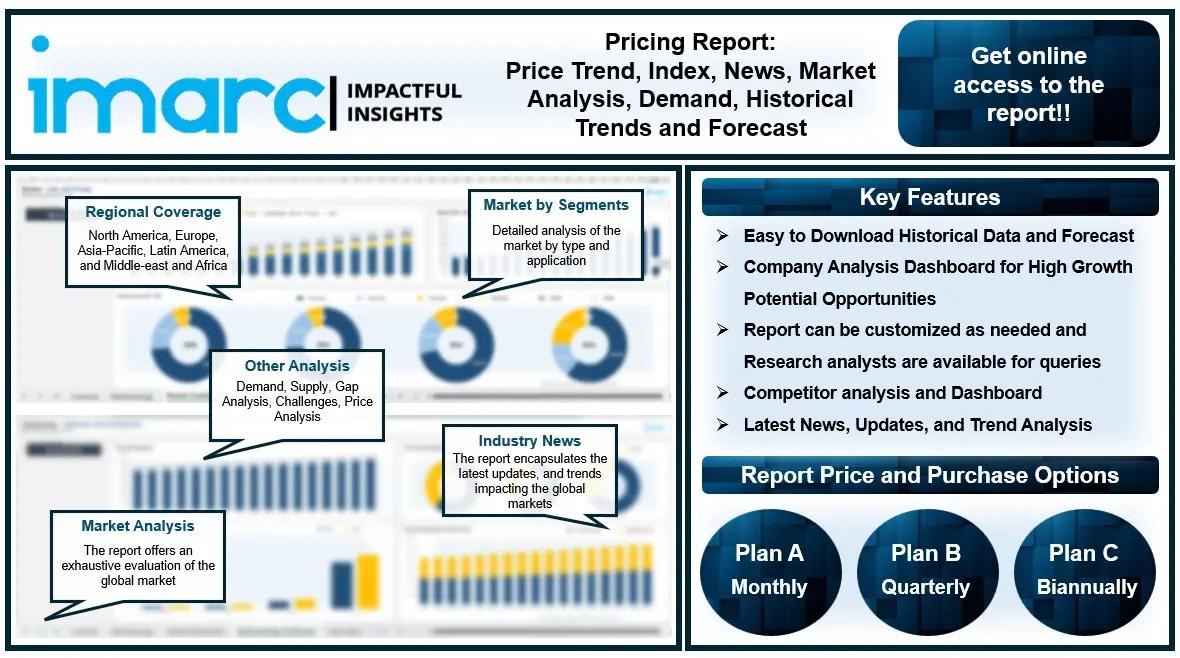

The latest report by IMARC, titled " White Oil Pricing Report 2024: Price Trend, Chart, Market Analysis, News, Demand, Historical and Forecast Data," delivers a comprehensive analysis of white oil prices on a global and regional scale, highlighting the pivotal factors contributing to price changes. This detailed examination includes spot price evaluations at key ports and an analysis of pricing structures, such as Ex Works, FOB, and CIF, across North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

White oil Prices December 2023:

- China : 1148 USD/MT

Report Offering:

- Monthly Updates - Annual Subscription

- Quarterly Updates - Annual Subscription

- Biannually Updates - Annual Subscription

The study delves into the factors affecting white oil price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the market, equipping stakeholders with the latest information on market fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request For a Sample Copy of the Report: https://www.imarcgroup.com/white-oil-pricing-report/requestsample

White oil Price Trend- Q4 2023

The white oil market is experiencing significant growth, driven by its rising product utilization across pharmaceuticals, cosmetics, and food processing industries. In the pharmaceutical sector, white oil is used as a base for ointments, laxatives, and other medicinal creams due to its high purity and stability, which ensures that it does not interfere with the efficacy of the active ingredients. The cosmetics industry relies heavily on white oil for its non-comedogenic and non-irritating properties, making it a key component in lotions, creams, and other personal care products. Additionally, the food industry utilizes white oil in the production of food packaging and in machinery as a lubricant that is safe for incidental food contact. The growing global demand for higher standards in product safety and purity is pushing manufacturers to invest in high-quality white oils. Enhanced regulatory scrutiny across these industries ensures that only the highest grade of white oil is used, further stimulating market growth. As such, the combination of broad application scope, stringent regulatory standards, and intrinsic product properties are central to the continued expansion of the white oil market.

White oil Market Analysis

The global white oil market size reached US$ 2.1 Billion in 2023. By 2032, IMARC Group expects the market to reach US$ 2.8 Billion, at a projected CAGR of 3.00% during 2023-2032. Over the last quarter, white oil prices have been influenced by a myriad of factors related to supply chain dynamics, raw material availability, and geopolitical events. One of the primary factors has been the fluctuating prices of base oils, a key raw material in the production of white oil. The volatility in crude oil markets, influenced by OPEC decisions to change U.S. shale oil production levels and geopolitical tensions in key oil-producing regions, has directly impacted base oil prices. These fluctuations are often passed on to the production costs of white oil, affecting its market price. Additionally, the global economic rebound from the pandemic has led to an increase in manufacturing and industrial activity, particularly in Asia and North America, which has augmented the demand for white oils, placing upward pressure on prices. Moreover, logistical challenges have continued to play a significant role in influencing white oil prices. The COVID-19 pandemic has had a lasting impact on global shipping and freight services, causing delays and increasing shipping costs. The congestion in major ports and the shortage of containers have led to increased lead times and higher transportation costs for white oil. These logistical issues are compounded by the stringent quality requirements and safety standards required for transporting white oils, which limit the number of viable shipping and handling options. As industries continue to recover and ramp up production to meet renewed demand, these logistical challenges are likely to persist, impacting the supply chain and pricing structure of white oils. The combined effect of raw material cost volatility and supply chain disruptions thus remains a pivotal factor in shaping the pricing landscape of the white oil market. Despite the decline in upstream crude oil prices, white oil prices in North America remained largely stable. The main factor contributing to the prices' stability is the cosmetics industry's moderate demand, even though upstream crude oil prices declined by about 16%, which was intended to lower production costs. White oil prices in the Asia-Pacific area remained steady in Q42023 despite modest downstream industry demand. The Chinese market showed little movement in white oil prices, even though upstream crude oil prices declined and there was already a big enough difference between supply and demand. September saw a slight 1% increase in automobile sales, indicating steady demand in the downstream automotive sector. White The fourth quarter of 2024 saw a fluctuating trend in oil prices on the European market. Technical grades fluctuated, with the rising sales in the automotive industry in October and November 2023 but falling in December of the same year.

Browse Full Report: https://www.imarcgroup.com/white-oil-pricing-report

Key Points Covered in the White oil Pricing Report:

The report delivers the following key findings, alongside a comprehensive breakdown of prices by region:

- White oil Prices

- White oil Price Trend

- White oil Demand & Supply

- White oil Market Analysis

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- White oil Price Analysis

- White oil Industry Drivers, Restraints, and Opportunities

- White oil News and Recent developments

- Global Event Analysis

- List of Key Players

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece

- North America: United States and Canada

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

𝐁𝐫𝐨𝐰𝐬𝐞 𝐌𝐨𝐫𝐞 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐈𝐌𝐀𝐑𝐂 𝐆𝐫𝐨𝐮𝐩:

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163