Oil storage facilities are integral to the smooth functioning of global energy markets, playing a crucial role in maintaining supply stability, managing price volatility, and ensuring energy security. This article delves into the essential functions and significance of oil storage in the context of global energy dynamics.

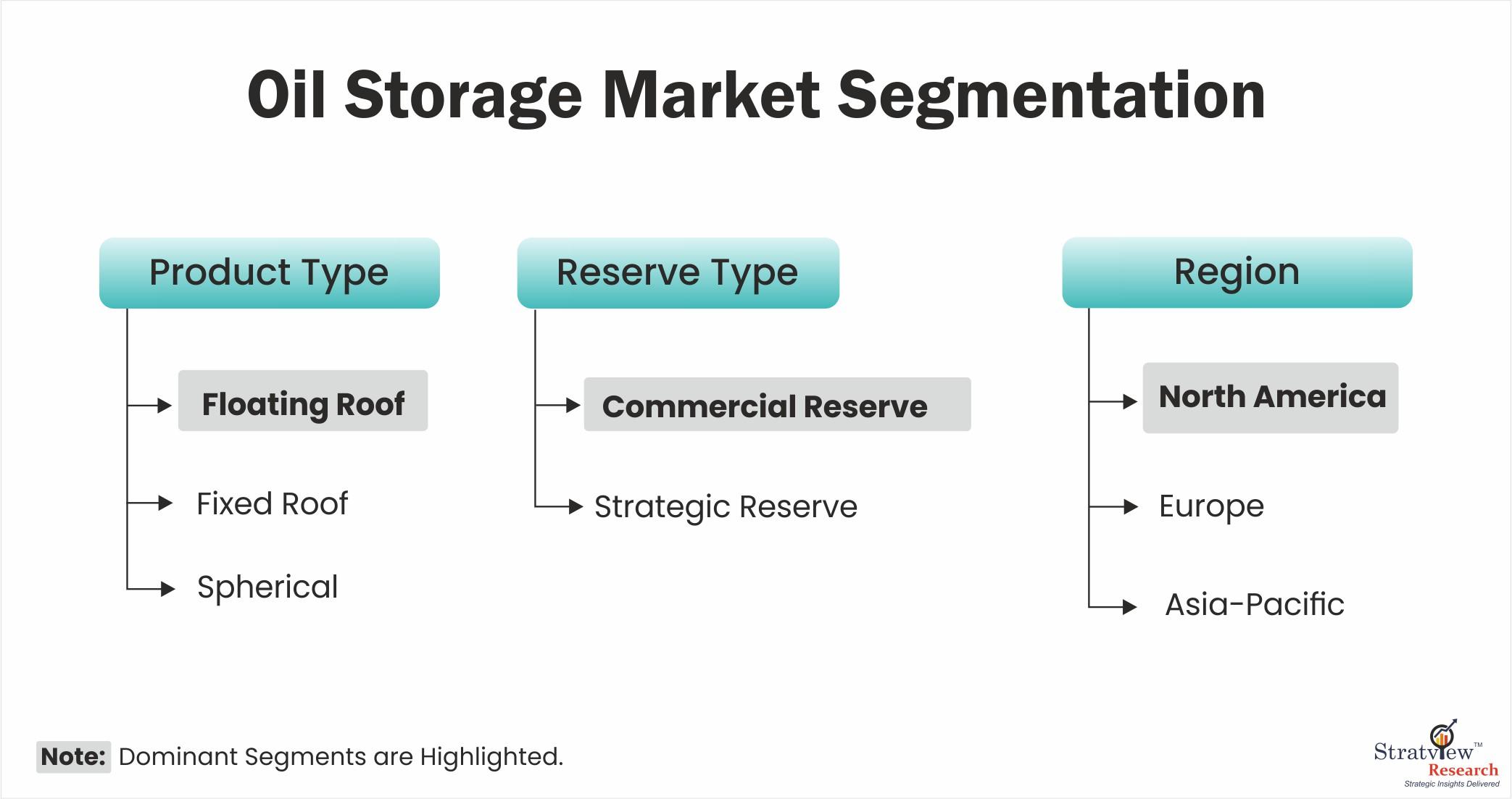

According to Stratview Research, the oil storage market was estimated at USD 12.0 billion in 2021 and is likely to grow at a CAGR of 4.2% during 2022-2027 to reach USD 15.3 billion in 2027.

- Balancing Supply and Demand

Oil storage serves as a buffer between production and consumption. It allows producers to store excess crude oil during periods of oversupply when demand is low. Conversely, it ensures adequate supply during periods of increased demand or disruptions in production or transportation networks. This flexibility helps stabilize oil prices and mitigate market fluctuations, thereby contributing to economic stability and energy security.

- Managing Price Volatility

Oil prices are highly sensitive to changes in supply and demand dynamics, geopolitical events, and economic conditions. Oil storage facilities play a critical role in smoothing out price volatility by absorbing excess supply or releasing stored oil during supply shortages. This strategic management helps prevent price spikes or crashes that can impact global economies, industries, and consumers.

- Supporting Strategic Reserves

Many countries maintain strategic petroleum reserves (SPRs) as part of their energy security strategy. These reserves are stored in dedicated oil storage facilities and serve as a safeguard against supply disruptions caused by geopolitical tensions, natural disasters, or emergencies. Strategic reserves ensure that nations can quickly respond to unforeseen events and maintain essential services and industries dependent on reliable energy supply.

- Facilitating Global Trade and Transportation

Oil storage facilities are strategically located near major shipping lanes, refineries, and distribution hubs, facilitating efficient global trade and transportation of crude oil and petroleum products. Storage terminals enable seamless transfer between different modes of transport, including pipelines, tankers, and trucks, ensuring a steady flow of oil to markets worldwide.

- Enabling Market Arbitrage and Risk Management

Oil storage supports market arbitrage opportunities by allowing traders and refiners to take advantage of price differentials between current and future oil prices. Storage operators and traders can buy oil when prices are low, store it, and sell it when prices rise, thereby managing financial risks and optimizing profits in volatile markets.

Conclusion

In conclusion, oil storage plays a fundamental role in global energy markets by ensuring supply security, stabilizing prices, supporting trade and transportation, and enabling strategic reserves. As global energy demand continues to evolve, the importance of efficient and reliable oil storage infrastructure will only grow, reinforcing its critical role in maintaining energy stability and resilience in the face of geopolitical uncertainties and market dynamics. Understanding these vital functions underscores the indispensable nature of oil storage in the broader context of global energy security and economic stability.