Highly potent compounds have emerged as one of the key modalities in the healthcare community owing to their numerous advantages, including stable nature, enhanced efficacy at lower doses, selective mechanism of action and significantly lower side effects

Roots Analysis has announced the addition of “HPAPI and Cytotoxic Drug Manufacturing Market (4th Edition), 2022 – 2035” report to its list of offerings.

Manufacturing of highly potent compounds is a laborious procedure, plagued with various difficulties, including high capital investment, extensive operational expertise, as well as access to advanced infrastructure and technologies. As a result, outsourcing has become a preferred business model in this domain, providing increased flexibility, reduced costs and timely launch of drugs. Further, to keep up with the evolving client requirements, several contract manufacturing organizations have upgraded their existing capabilities / facilities.

Key Market Insights

More than 140 companies claim to offer highly potent active pharmaceutical ingredients (HPAPI) and cytotoxic drug contract manufacturing services, globally

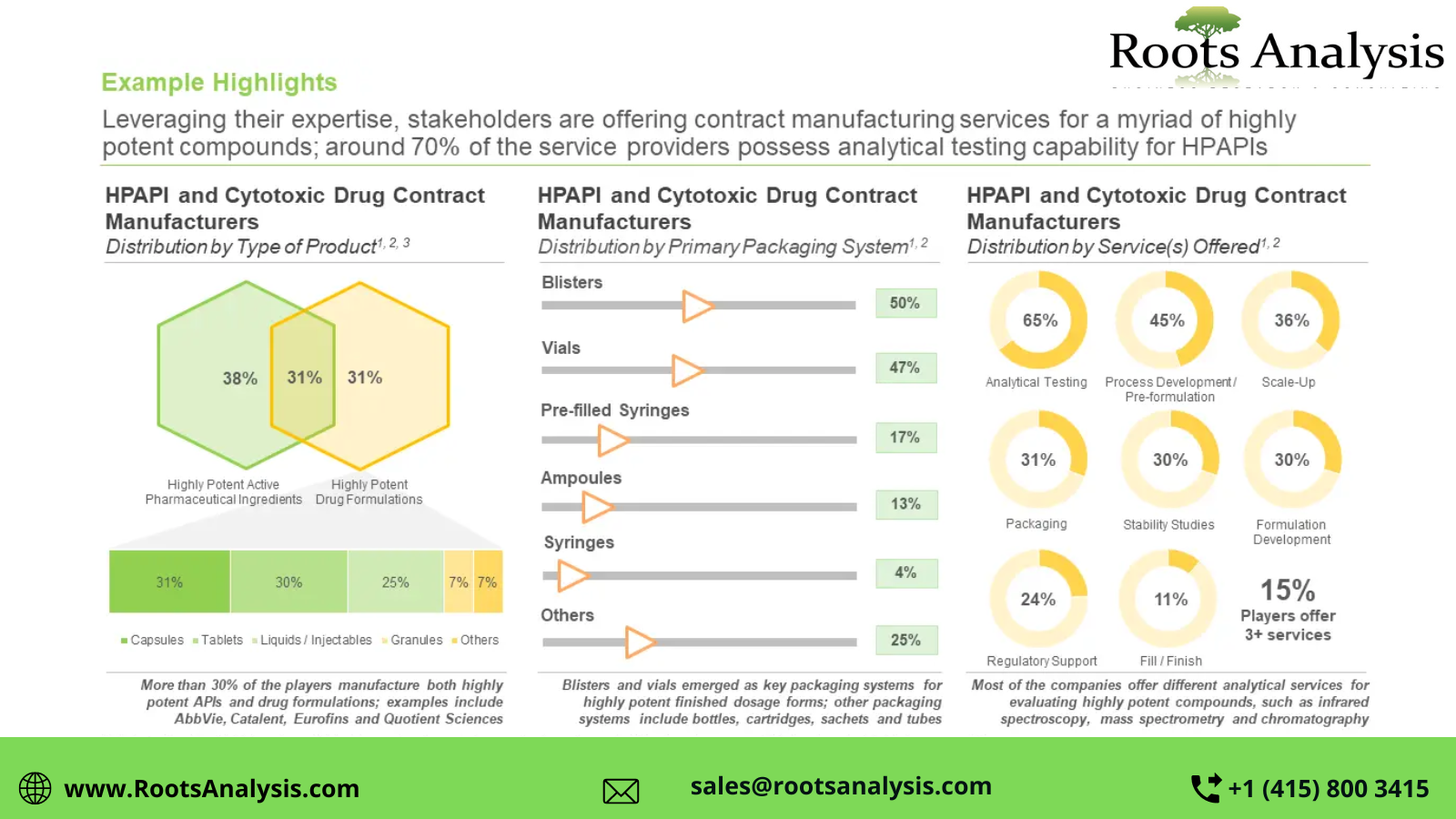

Majority (44%) of the industry stakeholders are based in Europe, followed by those having headquarters in North America (35%). Further, more than 30% of the service providers claim to have the required capabilities to manufacture both HPAPIs and highly potent finished dosage forms. It is also worth mentioning that over 50% of the players offer contract manufacturing services for HPAPI and cytotoxic drugs across all the three scales of operation.

Around 35% of partnership agreements were inked post 2020

Majority of the agreements related to HPAPI manufacturing were observed to be instances of acquisitions, representing 21% of the total partnerships. Further, most of the intercontinental, as well as intracontinental, deals have been inked by players based in Europe.

Over 95 expansion initiatives have been observed since 2018

Around 50% of the initiatives were focused on expanding the existing highly potent compound manufacturing facilities, followed by instances of capacity expansions (27%) and new facility additions (24%). More than 65% of the expansions reported in this domain were local initiatives, followed by international initiatives (33%).

Global installed HPAPI contract manufacturing capacity is currently estimated to be more than 2.5 million liters

The maximum share (83%) of the current installed capacity is expected to be captured by very large players. Moreover, close to 40% of the global, installed manufacturing capacity is available with facilities located in the Europe region.

North America and Europe are anticipated to capture more than 70% of the market share, by 2035

The market in Asia Pacific is likely to grow at a relatively faster pace (12.8%), in the long term. Currently, majority share (62%) of the overall HPAPI and cytotoxic drug contract manufacturing market is captured by HPAPIs; this trend is unlikely to change in the foreseen future as well. Further, in 2035, over 80% of the market share is likely to be captured by highly potent small molecules.

To request a sample copy / brochure of this report, please visit

https://www.rootsanalysis.com/reports/299/request-sample.html

Key Questions Answered

- Who are the key players engaged in offering contract manufacturing services for HPAPIs and cytotoxic drugs?

- What are the current opportunities within the HPAPI and cytotoxic drug market?

- What is the relative competitiveness of HPAPI and cytotoxic drug contract manufacturers?

- What types of partnership models are commonly adopted by stakeholders in this industry?

- What are the different types of expansion initiatives being undertaken by HPAPI and cytotoxic drug contract manufacturers?

- What are the key challenges faced by HPAPI and cytotoxic drug contract manufacturers?

- What are the key market trends and driving factors that are likely to impact this market?

- How is the revenue generation potential associated with HPAPI and cytotoxic drug manufacturing market likely to evolve in the coming years?

The financial opportunity within the HPAPI and cytotoxic drug manufacturing market has been analyzed across the following segments:

- Type of Product

- Highly Potent Active Pharmaceutical Ingredient

- Highly Potent Finished Dosage Form

- Company Size

- Small

- Mid-sized

- Large

- Very Large

- Scale of Operation

- Preclinical

- Clinical

- Commercial

- Type of Molecule

- Small Molecules

- Biologics

- Type of Highly Potent Finished Dosage Form

- Injectables

- Oral Solids

- Creams

- Others

- Key Geographical Regions

- North America (US, Canada and Mexico)

- Europe (UK, Italy, Germany, France, Spain and Rest of Europe)

- Asia-Pacific (China, India and Rest of Asia-Pacific)

- Rest of the World

The report also features inputs from eminent industry stakeholders, according to whom, continuous growth of the oncological therapeutics pipeline and the increasing preference for outsourcing is likely to drive the growth of the overall HPAPI and cytotoxic drug manufacturing market, in the foreseen future. The report includes detailed transcripts of discussions held with the following experts:

- Justin Mason-Home (Owner and Director, HPAPI Project Service)

- Antonella Mancuso and Maria Elena Guadagno (Vice President and Chief Operating Officer and Business Director, BSP Pharmaceuticals)

- Scott Patterson (Vice President Pharma/Bio Technical Support, ILC Dover)

- Stacy McDonald and Jennifer L. Mitcham (Ex-Group Product Manager and Ex-Director-Business Development); Abul Khair (Business Development Associate, Catalent)

- Roberto Margarita (Business Development Director, CordenPharma)

- Klaus Hellerbrand (Managing Director, ProJect Pharmaceutics)

- Kevin Rosenthal (Ex-Business Head, Formulations and Finished Products, Alphora Research (Acquired by Eurofins))

- Mark Wright (Ex-Site Head, Grangemouth, Piramal)

- Allison Vavala (Ex-Senior Manager, Business Development, Helsinn)

- Valentino Mandelli (Marketing and Sales Manager, Pharma, Cerbios-Pharma)

- Javier E. Aznarez Araiz (Ex-Business Development, Idifarma)

The research includes profiles of key players (listed below); each profile features a brief overview of the company, details related to its financial performance (if available), recent developments and an informed future outlook.

- AbbVie

- Abzena

- Aenova

- Cambrex

- CARBOGEN AMCIS

- Catalent

- Hovione

- Intas Pharmaceuticals

- Lonza

- Pfizer CentreOne

- Piramal Pharma Solutions

- Scinopharm

- STA Pharmaceutical (a WuXi AppTec company)

- Syngene

- Teva API

For additional details, please visit

https://www.rootsanalysis.com/reports/view_document/hpapi-and-cytotoxic-drugs-manufacturing/299.html or email [email protected]

You may also be interested in the following titles:

- Biopharmaceutical Contract Manufacturing Market: Industry Trends and Global Forecasts, 2022-2035

- ADC Contract Manufacturing Market (5th Edition): Industry Trends and Global Forecasts, 2022-2035

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Contact:

Ben Johnson

+1 (415) 800 3415

[email protected]