"Global Insurtech Market, By Product (AI, Hadoop, Block Chain), Application (Products, Services), Type (Auto, Business, Health, Home, Speciality, Travel) - Industry Trends and Forecast to 2029

The Insurtech Market sector is rapidly evolving, with substantial growth and advancements anticipated by 2031. Comprehensive market research provides an in-depth analysis of market size, share, and trends, offering crucial insights into its expansion. The report delves into market segmentation and definitions, highlighting key components and drivers. By utilizing SWOT and PESTEL analyses, it assesses the market's strengths, weaknesses, opportunities, and threats, along with political, economic, social, technological, environmental, and legal factors.

Insurtech Market Industry Trends and Forecast to 2031

What are the projected market size and growth rate of the Insurtech Market?

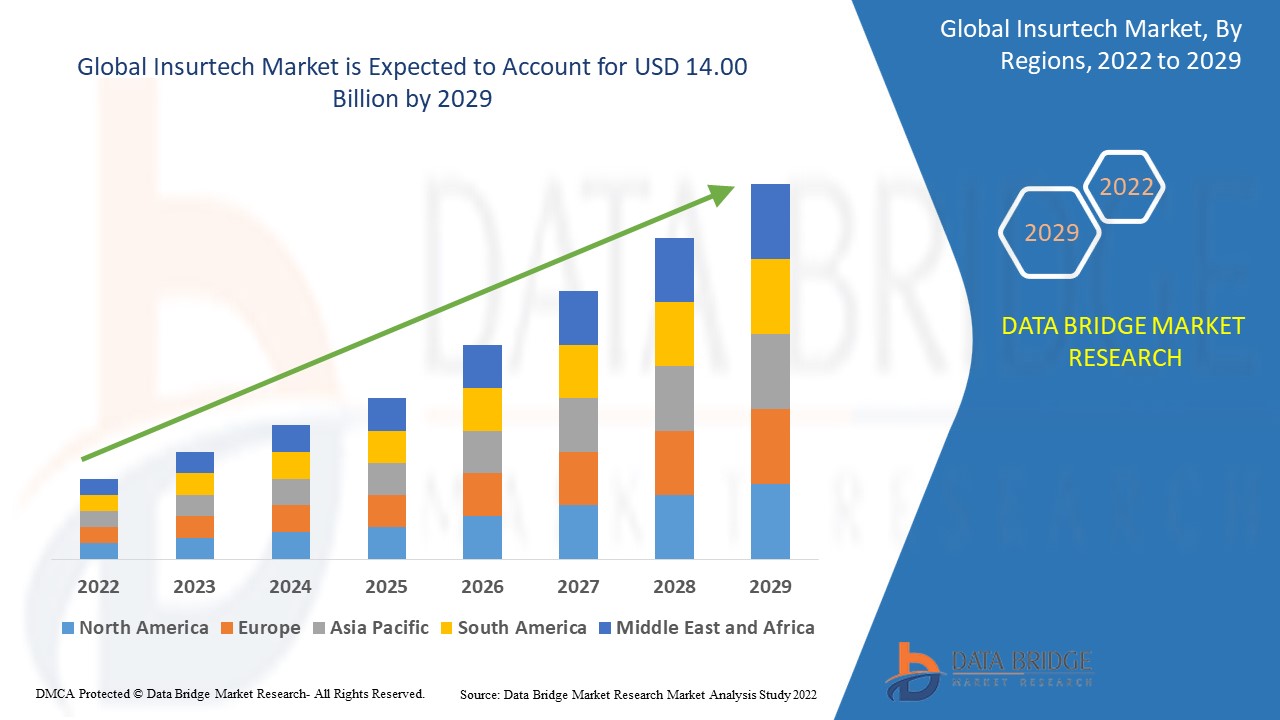

Data Bridge Market Research analyses that the Global Insurtech Market which was USD 3.7 Million in 2021 is expected to reach USD 14 Billion by 2029 and is expected to undergo a CAGR of 18.10% during the forecast period of 2021 to 2029

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-insurtech-market

Which are the top companies operating in the Insurtech Market?

The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the Insurtech Market extension. This Insurtech Market report provides the information of the Top 10 Companies in Insurtech Market in the market their business strategy, financial situation etc.

**Insurtech Market Analysis**

In 2021, the global insurtech market witnessed significant growth due to the increasing adoption of digital technologies in the insurance sector. The COVID-19 pandemic acted as a catalyst for the digitization of insurance processes, leading to a surge in demand for insurtech solutions. As customers increasingly sought contactless and convenient insurance services, insurtech companies capitalized on the opportunity to provide innovative solutions. The market was characterized by a focus on improving customer experience, enhancing operational efficiency, and leveraging data analytics for personalized insurance offerings.

**Segments:**

- **Insurance Type:**

- Life Insurance

- Health Insurance

- Property and Casualty Insurance

- Others

- **Technology:**

- Artificial Intelligence

- Blockchain

- Internet of Things (IoT)

- Machine Learning

- Others

- **End-User:**

- Insurers

- Insurance Agents

- Policyholders

Moving forward to 2029, the insurtech market is poised for continued growth and innovation. The increasing integration of advanced technologies such as artificial intelligence, machine learning, and blockchain will drive the development of more sophisticated insurtech solutions. Insurtech companies will focus on expanding their offerings to address the evolving needs of insurers and policyholders. Personalized insurance products, automation of claims processing, and real-time risk assessment are expected to be key trends shaping the market in 2029.

**Market Players:**

- Lemonade

- Oscar Health

- Metromile

- Hippo

- Policygenius

- ZhongAn

- Root Insurance

- OneConnect

- Clover Health

- Next Insurance

Overall, the insurtech market is set to experience robust growth over the forecast period, driven by the increasing digitalization of the insurance industry and the growing demand for innovative insurance solutions. Insurtech companies that can differentiate themselves through cutting-edge technologies, seamless customer experiences, and strategicThe insurtech market is on a trajectory of exponential growth, fueled by evolving consumer preferences, technological advancements, and industry disruptions. One of the key drivers propelling the market forward is the increasing consumer demand for personalized insurance products tailored to their individual needs and preferences. Insurtech companies are leveraging technologies such as artificial intelligence and machine learning to analyze vast amounts of data and gain insights into customer behavior, risk profiles, and market trends. This data-driven approach allows insurers to offer customized insurance solutions, improving customer satisfaction and loyalty.

Another significant trend shaping the insurtech market is the automation of claims processing. By implementing advanced technologies like robotic process automation and natural language processing, insurtech companies are streamlining and accelerating the claims settlement process. This not only enhances operational efficiency but also reduces the likelihood of human errors and fraudulent claims. Insurers can deliver a faster and more seamless claims experience to policyholders, ultimately leading to higher customer retention rates and brand reputation.

Furthermore, real-time risk assessment is emerging as a critical capability within the insurtech sector. With the proliferation of Internet of Things (IoT) devices and sensors, insurers can collect real-time data on policyholders' behaviors, lifestyles, and environments. This wealth of data enables insurers to assess risks more accurately and dynamically adjust premiums based on individual risk profiles. Real-time risk assessment not only benefits insurers by optimizing their underwriting processes but also empowers policyholders to proactively manage and mitigate risks, fostering a culture of prevention and protection.

In addition to technological advancements, strategic partnerships and collaborations are shaping the competitive landscape of the insurtech market. Insurtech companies are forging alliances with traditional insurers, technology providers, and data analytics firms to enhance their product offerings, expand their market reach, and drive innovation. By combining their expertise and resources, these partnerships enable insurtech companies to develop holistic solutions that address the diverse needs of insurers, agents, and policyholders.

Overall, the insurtech market is witnessing a paradigm shift towards**Market Players:**

DXC Technology Company (US)

Trov, Inc. (US)

Wipro Limited (India)

ZhongAn (China)

TCS (India)

Cognizant (US)

Infosys (India)

Pegasystems (US)

Appian (US)

Mindtree (India)

Prima Solutions (India)

Fineos (Ireland)

Bolt Solutions (US)

Majesco (US)

EIS Group (US)

Oscar Insurance (US)

Quantemplate (UK)

Shift Technology (India)

The insurtech market is experiencing a period of rapid evolution and transformation, driven by the convergence of technology, changing consumer behavior, and industry partnerships. Insurtech companies are at the forefront of innovation, leveraging advanced technologies like artificial intelligence, machine learning, and blockchain to revolutionize the insurance industry. The focus on personalized insurance products tailored to individual needs and preferences is reshaping the market landscape, leading to enhanced customer satisfaction and loyalty.

Automation of claims processing is a key trend gaining traction within the insurtech sector. By implementing cutting-edge technologies such as robotic process automation and natural language processing, insurtech companies are streamlining claims settlement processes, improving operational efficiency, and reducing errors and fraud. This emphasis on efficient claims processing not only benefits insurers by optimizing workflows but also enhances the overall customer experience, driving higher retention rates and brand reputation.

Real-time risk assessment is emerging as a pivotal capability within the insurtech market, enabled by the

Explore Further Details about This Research Insurtech Market Report https://www.databridgemarketresearch.com/reports/global-insurtech-market

Browse More Reports:

Patient Derived Xenografts Market

Medical Tapes and Bandages Market

Migraine Drugs Market

Dental Adhesive Market

Cell Harvesting Market

Stem Cell Manufacturing Market

Wood Coating Resins Market

Aerospace Composites Market

Angina Market

Ceramic Inks Market

North America Metal Finishing Chemicals Market

Europe Metal Finishing Chemicals Market

Asia-Pacific Metal Finishing Chemicals Market

Ultraviolet (UV) Curing System Market

Automation Testing Market

Paper Dyes Market

Polytetrafluoroethylene Market

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975

Email:- [email protected]

"