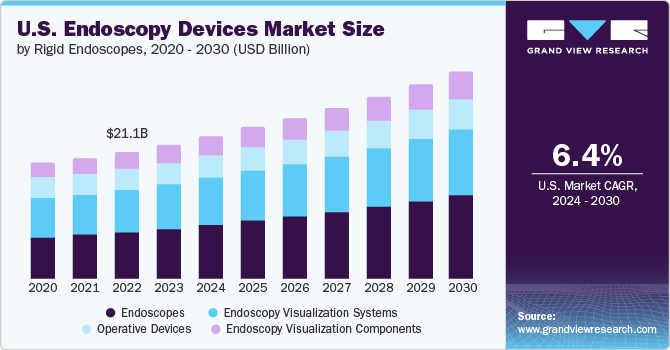

The U.S. endoscopy devices market size is expected to reach USD 32.55 billion by 2030, registering a CAGR of 6.4% from 2024 to 2030, according to a new report by Grand View Research, Inc. The development of novel endoscopic devices through technological innovation is also expected to fuel market expansion in the United States during the forecast period. The leading manufacturers are constantly seeking to develop cutting-edge endoscopic solutions that will improve the diagnosis and treatment of various chronic illnesses.

Technological developments, the growing prevalence of endoscopy for diagnosis and treatment, and patient preferences for less intrusive surgeries are the key factors driving the market expansion. Furthermore, it is projected that developments in endoscopic technology, including as robotic-assisted systems, high-definition imaging, and capsule endoscopy, will improve endoscopists' diagnostic and therapeutic capacities and support market growth. Furthermore, a rise in endoscopic treatments for the early detection of colorectal and gastrointestinal malignancies is anticipated to propel the market in the next years. Most gastrointestinal stromal tumors begin in the colon, esophagus, or rectum.

The report “U.S. Endoscopy Devices Market Size, Share & Trends Analysis Report By Product (Endoscopes, Endoscopy Visualization Systems), By End Use, And Segment Forecasts, 2024 – 2030” is available now to Grand View Research customers and can also be purchased directly

Government organizations are also more committed to and supportive of the cutting-edge concepts tht must be put into practice in order for endoscopes to offer procedures free from contamination. For example, in April 2022, the US FDA revised a safety statement regarding duodenoscopes and advised medical facilities and hospitals to "complete transition to innovative duodenoscope designs" because of worries about patient cross-contamination and reprocessing.

Moreover, the market is growing as a result of the strategic actions taken by industry participants to increase their endoscopic offerings, including product approvals, launches, alliances, and acquisitions. For example, AA Medical and Certified Endoscopy Products, a Chicago-based medical device reprocessing business that specializes in endoscopic tools, collaborated in January 2023. A reputable medical device reprocessing business for the orthopedic, endoscopic, and other surgical equipment markets was established by AA Medical and Certified Endoscopy.

Moreover, the increasing global incidence of cancer is driving the use of endoscopic instruments for early cancer detection and management. For example, GLOBOCAN 2020 projects that there will be 19.3 million new cases of cancer worldwide in 2020, and that the disease would cause about 10 million deaths. Furthermore, the growing inclination towards biopsies as a means of cancer diagnosis and detection in recent times is probably going to spur more people to use endoscopic devices, which will ultimately propel the endoscopy device market over time.

Order your free sample copy of “U.S. Endoscopy Devices Market Report 2024 - 2030, published by Grand View Research

U.S. Endoscopy Devices Market Report Highlights:

- The endoscopes segment dominated the market in 2023 with revenue share of 36.8% and is expected to witness the fastest CAGR growth from 2024 to 2030. An advanced healthcare infrastructure, high investments by market players and hospitals promoting the use of novel endoscopy equipment, and favorable reimbursement policies are among the factors expected to drive market growth in the U.S.

- The outpatient facilities segment held the largest revenue share in 2023 and is anticipated to grow at the fastest CAGR of 7.1% from 2024 to 2030. The growing number of outpatient care centers in the U.S. boosts the market growth. These outpatient centers offer effective diagnostic and therapeutic options

- The hospital's segment in the market held a significant revenue share in 2023. Favorable reimbursement policies for patients visiting hospitals compared to those opting for treatment at ambulatory centers and a significant presence of hospitals and primary care centers in developed and developing economies contribute to the high demand for endoscopes

U.S. Endoscopy Devices Market Segmentation

Grand View Research has segmented the U.S. endoscopy devices market based on product, end use:

U.S. Endoscopy Devices Product Outlook (Revenue, USD Million, 2018 – 2030)

-

- Endoscopes

- Endoscopy Visualization Systems

- Endoscopy Visualization Components

- Operative Devices

U.S. Endoscopy Devices End Use Outlook (Revenue, USD Million, 2018 – 2030)

-

- Hospitals

- Outpatient Facilities

List of Key Players in the U.S. Endoscopy Devices Market

- Johnson & Johnson (Ethicon Endo-Surgery, Inc.)

- Stryker Corporation

- Boston Scientific Corporation

- CONMED

- Medtronic PLC

- Fujifilm Holdings Corporation

- Olympus Corporation

- KARL STORZ SE & Co. KG

- Richard Wolf GmbH

- Cook Medical

About Grand View Research:

Grand View Research, Inc. is a market research and consulting company that provides off-the-shelf, customized research reports and consulting services. To help clients make informed business decisions, we offer market intelligence studies, ensuring relevant and fact-based research across a range of industries, from technology to chemicals, materials, and energy. With a deep-seated understanding of varied business environments, Grand View Research provides strategic objective insights. For more information, visit www.grandviewresearch.com

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Email: [email protected]