The global sex toys market size is anticipated to reach USD 62.7 billion by 2030, growing at a CAGR of 8.69% during the forecast period, according to a new report by Grand View Research, Inc. The market growth can be attributed to the growing popularity of e-commerce sector owing to the growing desire for privacy and discretion in purchasing and using sex toys. Buying adult products online is convenient and discreet, and helps some customers avoid the embarrassment of in-store visit, thereby boosting the sales of such products via online channels. According to Thatpersonal.com published in 2023, the sale of sex toys increased by around 60% post-lockdown.

In addition, the growing interest among couples to enrich their intimate relationships with sex toys drives demand for products designed for shared experiences. Rising use of social media, pop culture influence, and liberalization are creating sexual health awareness, thus contributing to market growth. Moreover, the increasing adoption of AI by companies to increase customer satisfaction and provide technologically advanced solutions is expected to drive market growth over the forecast period. The market is also expected to witness robust growth owing to a shift towards the AI-driven SexTech industry.

Gather more insights about the market drivers, restrains and growth of the Global Sex Toys Market

Continuous innovation in product design, materials, and functionality is enhancing user experience and contributing to market growth. Companies are integrating cutting-edge technology, such as app-controlled devices, virtual reality, and smart functionalities to target consumers seeking novel and sophisticated experiences. For instance, in January 2023, Lovehoney Group launched a new range of sex toys, Lovehoney Roses collection, which includes three editions of toys, including a clitoral suction stimulator with Pleasure Air Technology.

Sex Toys Market Report Highlights

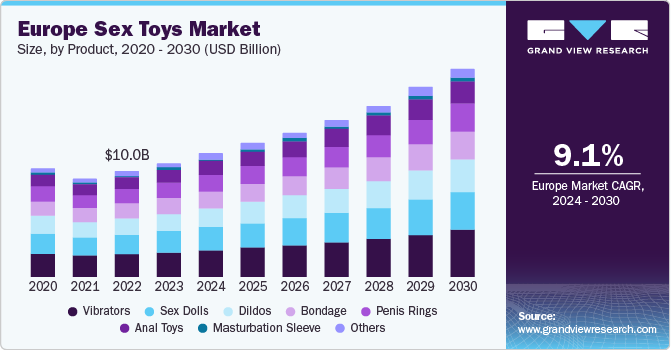

- Vibrators dominated the product segment with more than 22% revenue share in 2023, owing to innovative product launches and increasing awareness of women’s sexual health

- Based on distribution channel, the e-commerce segment held the largest revenue share in 2023, owing to the increasing internet penetration and product availability in online retail stores

- North America dominated the market for sex toys in 2023, owing to the growing product use, especially in the U.S. and the presence of many manufacturers, retail stores, and distributors

Regional Insights

North America held the largest revenue share of 33.24% in 2023, owing to the presence of numerous manufacturers and retailers providing easy access to products. Sex toy companies, such as Doc Johnson have manufacturing facilities in the U.S. and manufacture more than 75% of their products in the U.S. The company has R&D teams that provide continuous input for increasing its operations and output.

Key Sex Toys Company Insights

The market is highly competitive with the presence of global and local manufacturers & distributors. The competitive landscape in the industry is complex, encompassing various strategies related to product differentiation, branding, distribution, and compliance. BMS Factory and Fun Factory are some of the emerging players functioning in this market.

List of Key Players in the Sex Toys Market

- Church & Dwight Co., Inc.

- Reckitt Benckiser Group plc

- LELO

- LifeStyles Healthcare Pte Ltd

- Doc Johnson Enterprises

- Lovehoney Group Ltd

- BMS Factory

- PinkCherry

- Tenga Co., Ltd.

- Fun Factory

- We-Vibe

Order a free sample PDF of the Sex Toys Market Intelligence Study, published by Grand View Research.