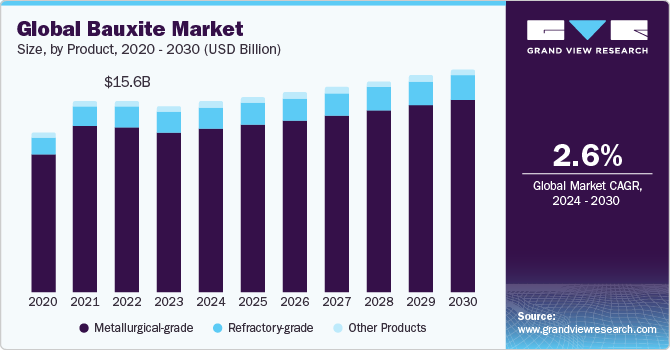

The global bauxite market size is anticipated to reach USD 18.15 billion by 2030, registering a CAGR of 2.6% from 2024 to 2030, according to a new report by Grand View Research, Inc. Increasing use of aluminum foil in the packaging industry is one of the key growth drivers for the market. The rising demand for packaged food is forcing aluminum foil manufacturers to invest in new production plants. For instance, in January 2022, SRF Limited, a manufacturer of industrial and specialty intermediates, decided to invest USD 55.80 million in setting up an aluminum foil manufacturing plant with a production capacity of 21,000 tons in Indore, Madhya Pradesh, India. Bauxite is an ore that contains a high level of aluminum content. The product is soft in nature with a hardness of 1 to 3 on the Mohs scale.

Different grades of products that are available in the market include metallurgical grade, refractory grade, abrasive grade, and chemical grade, which are used according to their application requirements. Based on products, the metallurgical-grade segment held the largest revenue share of the global market in 2023 and this trend is expected to continue throughout the forecast period. Metallurgical-grade bauxite is mainly used to produce alumina, which is a key raw material for primary aluminum production. Production of primary aluminum is mainly driven by its demand from downstream sectors. Asia Pacific was the largest regional market in 2023 and will remain dominant throughout the forecast period. China is anticipated to lead in the regional market; however, India is expected to register the fastest growth rate from 2024 to 2030.

Gather more insights about the market drivers, restrains and growth of the Global Bauxite Market

Increasing demand for aluminum from various application industries, such as construction, automotive, and electronics, has pushed the consumption of bauxite in the region. The global bauxite industry is highly competitive. Rising demand for aluminum compels bauxite mining companies to expand their mining and production capacities. For instance, in February 2024, MYTILINEOS Energy & Metals secured a license from Ghana Integrated Aluminium Development Corporation (GIADEC) to expand its mining operations in Ghana, Africa. The company aims to develop a manufacturing plant that can produce 10 million tons of bauxite per annum from an estimated 300 million tons of bauxite reserve.

Bauxite Market Report Highlights

- The metallurgical-grade product segment is anticipated to register the fastest CAGR of 2.7%, in terms of revenue, from 2024 to 2030. Aluminum is widely utilized in various end-use industries, such as automotive, medical, and construction, which is expected to drive segment growth

- The alumina production application segment is expected to register a CAGR of 2.8% from 2024 to 2030 due to increasing demand from downstream end-users, such as the automobile industry

- The North America regional market is expected to register the fastest CAGR of 4.2%, in terms of revenue, from 2024 to 2030. Rising emphasis on the EV industry and increasing demand for aluminum products will propel the growth of the regional market

- Key market players compete largely based on factors, such as quality, price, and proximity to customers, as well as strategically located long-term bauxite resources in Guinea, Australia, and Brazil, which are the world’s largest reserves of the product

- Furthermore, key players engage in capacity expansions, mergers & acquisitions, and R&D activities to stay ahead of their competitors

List of Key Players in the Bauxite Market

- Alcoa Corporation

- Rio Tinto

- Aluminum Corporation of China Limited (CHALCO)

- Norsk Hydro ASA

- South32

- Rusal

- NALCO India

- Hindalco Industries Ltd.

- Emirates Global Aluminium PJSC

Order a free sample PDF of the Bauxite Market Intelligence Study, published by Grand View Research.