Market Overview:

The mobile phone insurance market is experiencing rapid growth, driven by rising adoption of smartphones, increasing cost of mobile devices, and risks of accidental drops of mobile phones. According to IMARC Group’s latest research publication, ”Mobile Phone Insurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033″. The global mobile phone insurance market size reached USD 40.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 83.1 Billion by 2033, exhibiting a growth rate (CAGR) of 8.4% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/mobile-phone-insurance-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Factors Affecting the Growth of the Mobile Phone Insurance Industry:

- Rising Smartphone Penetration:

Another factor boosting demand in mobile phone insurance is global upsurge activity in adopting smartphones, especially the need for protection for antics created by users who tend to go for the more high-end devices. Such insurance transactions have gained popularity in emerging markets because here, premium smartphones are often a financial commitment. Insurers have come up with varying plans-mostly pay-as-you-go- for customers demanding lower-cost options. This trend is expected to grow as 5G service becomes even more available and leads to higher device costs; thus, insurance becomes a more vital issue for smartphone owners.

- Shift to Subscription Models:

Today, mobile phone insurance is moving toward subscription proposals, like other technologies. In addition to convenience, lower monthly payments/delivered premium costs are preferred by consumers. It has inspired insurers to add-device warranties, cloud storage, cybersecurity services, and other gadgets in premium packages. This value proposition has always been backed by alliance with carriers and manufacturers, who count on embedded insurance at the point of sale. This would increase customer retention besides creating recurring revenue streams for providers-a win-win proposition in a competitive market.

- Demand for Eco-Friendly Coverage:

Current trends in mobile phone insurance courtesy of sustainability are pulling consumers toward policies such as repair and replacements, which are also eco-friendly. These insurers have created incentives for device repairs by paying for all labor charges and giving discounts for replacement devices that are refurbished. Other providers complement these with carbon offset programs for their plans, targeting customers who really worry about the environment. As pressure mounts in regulations and consumer preference for adopting sustainable practices, insurers with a sustainable focus will always find a bigger place to stand when it comes to attracting long-term customers.

Leading Companies Operating in the Global Mobile Phone Insurance Industry:

- American International Group, Inc

- Allianz SE

- AmTrust International Limited

- Apple Inc., AT&T Inc.

- AXA Group

- Deutsche Telekom AG

- Liberty Mutual Insurance Group

- Pier Insurance Managed Services Ltd.

- Samsung Electronics Co. Ltd.

- SoftBank Group Corp.

- Sprint Corporation

- Telefónica Insurance S.A.

- Verizon Communications Inc.

- Vodafone Group Plc

- Xiaomi Corporation

- Orange S.A.

Mobile Phone Insurance Market Report Segmentation:

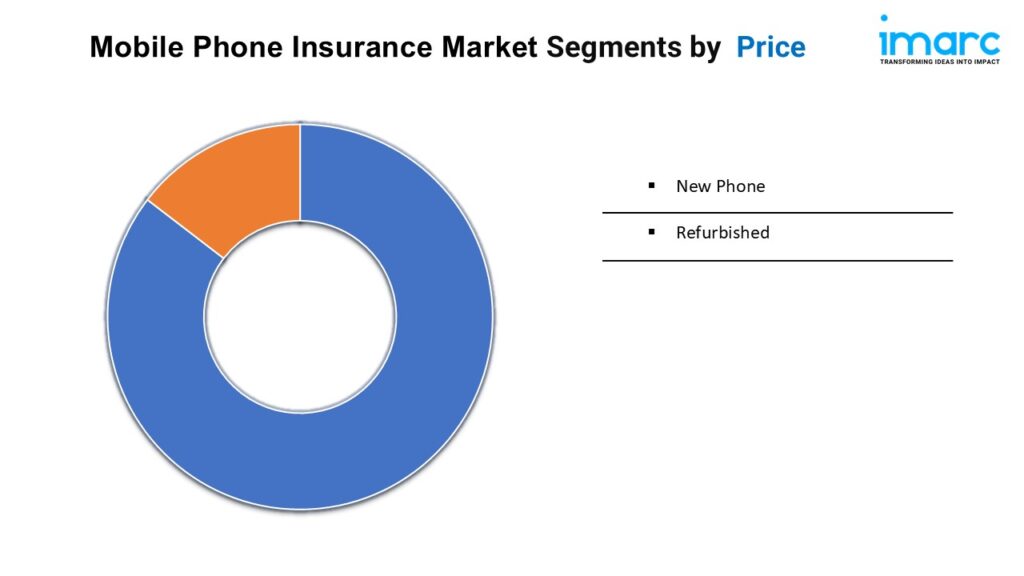

By Phone Type:

- New Phone

- Refurbished

The new phone represented the largest segment due to the rising need to reduce high replacement costs.

By Coverage:

- Physical Damage

- Electronic Damage

- Virus Protection

- Data Protection

- Theft Protection

Physical damage accounted for the largest market share as it provides protection for mobile phones against external harm, such as accidental drops and spills.

By Distribution Channel:

- Mobile Operators

- Device OEMs

- Retailers

- Online

- Others

Online exhibits a clear dominance in the market on account of the increasing focus on enhanced convenience and accessibility.

By End User:

- Corporate

- Personal

Personal holds the biggest market share as mobile phone insurance provides protection against numerous risks, such as accidental damage, theft, loss, and damage caused by environmental factors.

Regional Insights:

- North America: (United States, Canada)

- Asia Pacific: (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe: (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America: (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the mobile phone insurance market due to the presence of numerous insurance providers.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145