In the ever-evolving landscape of finance and technology, Fintech apps emerge as the vanguards of innovation, reshaping the way we manage, invest, and interact with our finances. As the financial industry undergoes a digital transformation, these apps stand at the forefront, offering a plethora of features that redefine the user experience.

The Fintech Revolution

The genesis of Fintech apps lies in the desire to democratize financial services, making them more accessible, efficient, and user-friendly. These applications leverage cutting-edge technology, including artificial intelligence, blockchain, and data analytics, to create a seamless and personalized financial ecosystem.

Mobile Banking Redefined

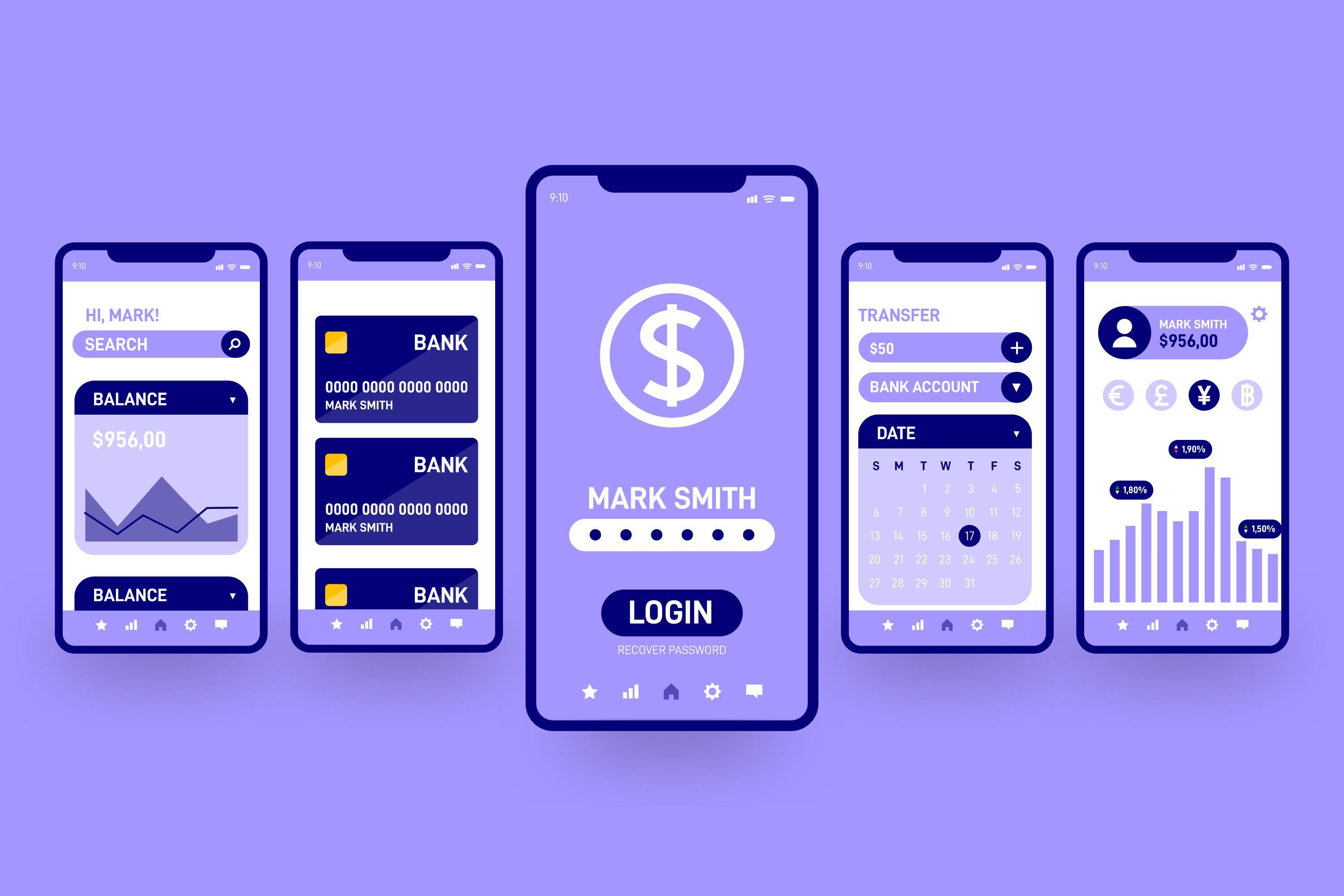

At the core of the fintech apps is the redefinition of mobile banking. Gone are the days of cumbersome paperwork and long queues; these apps bring banking services to the palm of your hand. From account management to fund transfers and bill payments, users can effortlessly navigate their financial landscape with a few taps on their smartphones.

Investment Platforms for Everyone

Investing, once perceived as a complex endeavor reserved for the financially savvy, is now democratized by Fintech apps. These platforms offer user-friendly interfaces, educational resources, and diversified investment options. Whether you're a seasoned investor or a novice, these apps provide tools to build and manage your investment portfolio seamlessly.

Digital Wallets and Contactless Payments

The advent of digital wallets has revolutionized the way we make payments. The fintech apps facilitate secure and convenient transactions through digital wallets, eliminating the need for physical cash. With features like contactless payments and peer-to-peer transfers, these apps make financial transactions swift and efficient.

Budgeting and Financial Planning

Empowering users to take control of their finances, Fintech apps integrate robust budgeting and financial planning tools. Through real-time expense tracking, budget creation, and financial goal setting, these apps offer insights into spending patterns and provide actionable recommendations for better financial management.

Cryptocurrency Integration

The rise of cryptocurrencies has found a home within the Fintech landscape. The fintech apps embrace the era of digital currencies, allowing users to buy, sell, and manage their cryptocurrency holdings. With secure wallets and real-time market insights, these apps bridge the gap between traditional finance and the cryptocurrency market.

Lending and Credit Solutions

Fintech apps are disrupting traditional lending models by introducing innovative credit solutions. From peer-to-peer lending platforms to instant personal loans, these apps leverage advanced algorithms to assess creditworthiness swiftly. This not only expedites the lending process but also opens avenues for individuals who may have been overlooked by traditional banking institutions.

Security and Privacy Measures

As the financial sector embraces digitalization, security and privacy become paramount concerns. The fintech apps prioritize robust security measures, including end-to-end encryption, multi-factor authentication, and biometric identification. Users can enjoy the convenience of digital finance without compromising the safety of their sensitive information.

Regulatory Compliance

Navigating the financial landscape requires adherence to strict regulatory standards. The fintech apps understand the importance of compliance and work in tandem with regulatory bodies to ensure the highest standards of security, transparency, and ethical practices. This commitment builds trust among users, fostering a positive and secure financial environment.

User Education and Empowerment

Beyond transactional features, Fintech apps prioritize user education. Interactive interfaces, informative content, and financial literacy modules empower users to make informed decisions about their money. This commitment to education fosters a sense of financial empowerment, encouraging users to actively participate in managing their financial well-being.

The Future of Fintech Apps

As we stand on the brink of a new era in finance, the trajectory of Fintech apps points toward even greater integration of technology and finance. The future promises innovations such as enhanced AI-driven financial advice, seamless cross-border transactions, and further collaborations between traditional financial institutions and Fintech disruptors.

In Conclusion

The fintech apps represent more than just a digital evolution of financial services; they signify a fundamental shift in the way we engage with our finances. Empowering users with unprecedented control, accessibility, and insight, these apps shape the future of finance, making it more inclusive, efficient, and tailored to individual needs.

Lastly, if you are an owner of an app and want to list it at the top of the list on our website, you can visit Mobileappdaily.