The structural battery market offers advantages like energy storage integrated into vehicles' framework and design, increasing vehicle range without adding to vehicle weight. Structural batteries can be incorporated into various components like roof panels, vehicle undercarriage, and doors to optimize space and enhance capacity. The global structural battery market provides a solution to power electronics and supplement conventional lithium-ion batteries. It enables distributed packaging of batteries throughout the vehicle for stable performance even if one battery fails.

The Global structural battery market is estimated to be valued at US$ 1.84 Bn in 2024 and is expected to exhibit a CAGR of 20.% over the forecast period 2024 To 2031.

Key Takeaways

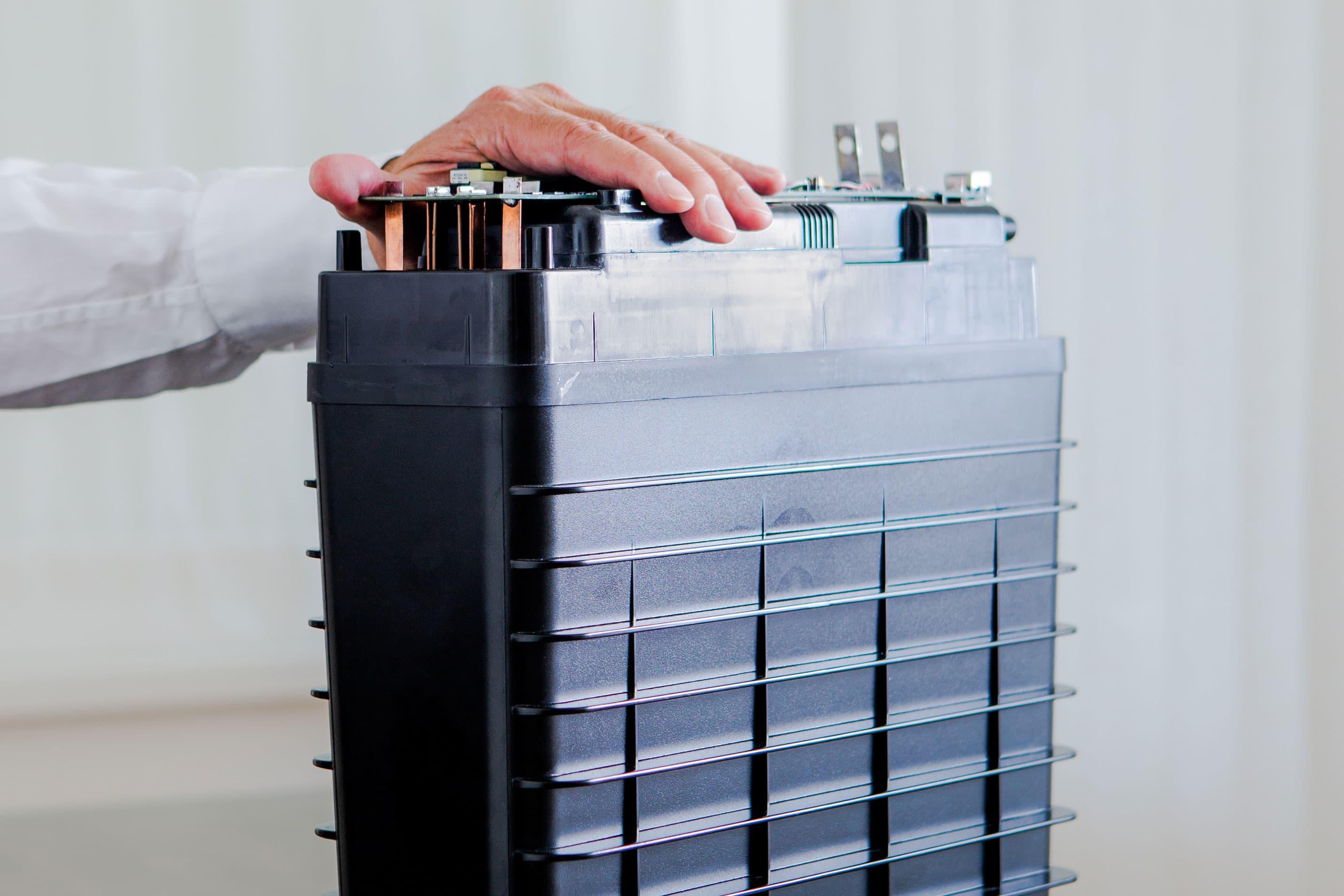

Key players operating in the structural battery market are Tesla, Inc. (United States), BMW AG (Germany), Airbus SE (France), Volkswagen AG (Germany), Samsung SDI Co., Ltd. (South Korea), Saft Groupe S.A. (France), Northvolt AB (Sweden), LG Chem Ltd. (South Korea), Farasis Energy, Inc. (China), Solid Power, Inc. (United States), Cadenza Innovation, Inc. (United States), Blue Solutions SA (France), Oxis Energy Ltd. (United Kingdom), Excellatron Solid State, LLC (United States), Amprius, Inc. (United States). Tesla is a pioneering leader in this market with their structural battery pack integration in Model 3 and Model Y vehicles.

The global Structural Battery Market Size is witnessing growing demand due to increasing electric vehicle sales worldwide. According to the International Energy Agency (IEA), global electric car sales rose by 41% in 2020 to over 3 million and continued growth is expected in coming years driven by favorable government policies and regulations.

Major automakers are expanding their structural battery development and production globally to cater to the growing electric mobility industry. For example, BMW has set up a structural battery lab in Germany and is collaborating with Swedish company Northvolt for a 23 billion-euro battery cell plant in Europe. Similarly, Volkswagen and Ford have invested in battery firms to boost their global electric vehicle battery manufacturing capabilities.

Market Drivers

The key driver for the structural battery market is the continuous decline in lithium-ion battery prices making electric vehicles more affordable. Additionally, stringent emission regulations in regions like Europe and China mandate lower fleet average CO2 emissions, pushing automakers to launch more electric models. Furthermore, supportive government policies around the world like subsidies, tax rebates and initiatives to develop charging infrastructure are fueling electric vehicle adoption, thereby boosting structural battery demand.

The ongoing geopolitical tensions are impacting the structural battery market growth. Due to supply chain disruptions and sanctions, manufacturers are facing challenges in sourcing key raw materials like lithium and cobalt. Many critical battery component suppliers are based in China and the tense geopolitical situation is increasing trade restrictions between major economies. This is hindering the easy access to key technologies, equipment and supplies needed for structural battery manufacturing.

Get more insights on Structural Battery Market