This Term Insurance Market report classifies the market into different segments based on techniques, application and end user. These Segments are studied in detail including the market estimates and forecast at regional and country level. The Segment analysis is useful in understanding the growth areas and probable opportunities in the market. This Term Insurance Market report provides comprehensive data to improve the understanding, scope and application. The analysis further includes a thorough description based on the dominant competitors that illuminate capacity, technology development, price structure, value chain and import /export activities.

The Term Insurance Market report examines and gives the worldwide market size of the principle players in every area. In addition, the report gives information of the main market players inside the market. The business changing elements for the market fragments are investigated in this report. This investigation report covers the development elements of the overall market dependent on end-clients. The report takes help of various analytical tools to predict the Term Insurance Market market growth of the market during the forecast period.

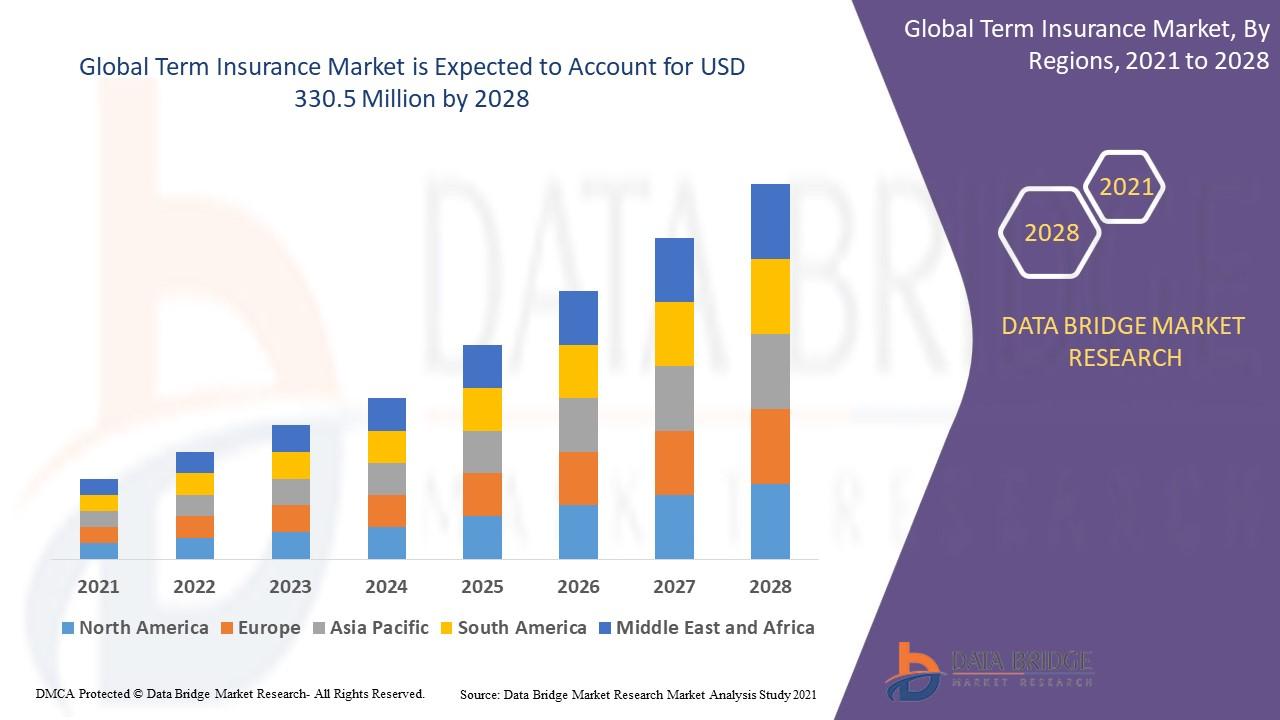

Global term insurance market size is expected to grow at a compound annual rate of 3.5% in the forecast period 2021 to 2028 and is likely to reach USD 330.5 million by 2028.

Definition

Term insurance provides a large amount of life cover that is, sum assured at a relatively low premium rate. In case of death of the person, the amount of benefit is paid to the nominee insured during the term of the policy. The major purpose of the term insurance plan is to offer financial security for the entire family in case of the unfortunate death or the critical illness of the policyholder.

Get a Sample Research Report @ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-term-insurance-market

Key Growth Drivers:

The prevalence of various diseases such as chronic diseases and disabilities across the globe are projected to proliferate the overall demand for term insurance market over the forecast period of 2021 to 2028. Moreover, the initiatives and efforts towards insurance reforms by government to raise awareness and the economic growth are significant factors for heightening the overall demand within the market. The adoption of advance technologies by key players to automate insurance process, minimize cost of operations and to improve efficiency is anticipated to further generate new opportunities for the term insurance market in the forecast period. However, the lack of awareness regarding the term insurance and the increasing premiums as policy holder ages are anticipated to act as a major restraint towards the growth of the market whereas the factors such as limited coverage of illness death which causes mistrust and the fact that most of the term insurances do not offer cash value which might create challenges for the growth of the market.

The report emphasizes the participation of key entities, notably:

Xero Limited, AlfaStrahovanie Group, Brighthouse Financial Inc, CNP Assurances Copyright, FWD Fuji Life Insurance Company, Limited, Great-West Lifeco Inc, ASSICURAZIONI GENERALI S.P.A, ICICI Prudential Life Insurance Co. Ltd, IndiaFirst Life Insurance Company Limited, Industrial Alliance Insurance and Financial Services Inc, John Hancock, MetLife Services and Solutions, LLC, OHIO NATIONAL SEGUROS DE VIDA SA, Ping An Insurance (Group) Company of China, Ltd, RBC Insurance Services Inc, SBI Life Insurance Company Limited, Sun Life Assurance Company of Canada, Tata AIA Life Insurance Company Ltd, Tokio Marine Holdings, Inc, Vitality, Zurich among other domestic and global players. Market share data is available for Global, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA) and South America separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Key Market Perspectives:

- Thorough examination of prevailing market tendencies

- Updates on the latest product advancements and innovations

- Term Insurance Market Compound Annual Growth Rate (CAGR) for both historic and forecasted years

- Strategies and activities of prominent players and brands in the field

- Insights into the industry landscape for emerging participants

Gain Additional Insight from This Premium Research Report @ https://www.databridgemarketresearch.com/reports/global-term-insurance-market

Key Market Segmentation

By Type (Level Term Policy, Renewable or Convertible, Annual Renewable Term, Mortgage Life Insurance), Level (Individual Level, Group Level, Decreasing), Distribution Channel (Direct Channel, Indirect Channel)

Browse More Reports:

https://www.databridgemarketresearch.com/reports/global-varicocele-market

https://www.databridgemarketresearch.com/reports/global-glass-syringe-market

https://www.databridgemarketresearch.com/reports/global-manhole-covers-market

About Data Bridge Market Research, Private Ltd

Data Bridge Market Research operates as a multinational management-consulting firm, boasting offices situated in both India and Canada. Renowned for our innovative and cutting-edge market analysis methodologies, we pride ourselves on our unparalleled durability and forward-thinking approaches. Our commitment lies in unravelling optimal consumer prospects and nurturing invaluable insights to empower your company's success within the market.

With a team comprising over 500 analysts specializing in various industries, we have been instrumental in serving over 40% of Fortune 500 companies on a global scale. Our extensive network boasts a clientele exceeding 5000+, spanning across the globe. At Data Bridge Market Research, our goal remains steadfast: to provide comprehensive market intelligence and strategic guidance to propel your business toward success.

Contact Us

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975

Email – [email protected]