Taxaudit, your trusted audit firm in Malaysia specializes in providing comprehensive auditing services, ensuring accuracy and compliance with regulatory standards. At Taxaudit, our dedicated team of professionals is committed to delivering personalized solutions tailored to your business needs. With a proven track record of excellence, we prioritize transparency and efficiency in every audit. Choose Taxaudit for a reliable partner in navigating the complex financial landscape, ensuring your business thrives with confidence.

- Owner at Audit Firm in Malaysia

- Lives in Malaysia

- Male

- 08/05/2000

- Followed by 0 people

Recent Updates

- Top Qualities to Look for in an Audit Firm in Johor Bahru

When selecting an audit firm in Johor Bahru, it's essential to consider several key qualities that will ensure you receive reliable, accurate, and trustworthy services. Here are the top qualities to look for.

For More Information Please Visit - https://taxaudit.com.my/services/audit/

Top Qualities to Look for in an Audit Firm in Johor Bahru When selecting an audit firm in Johor Bahru, it's essential to consider several key qualities that will ensure you receive reliable, accurate, and trustworthy services. Here are the top qualities to look for. For More Information Please Visit - https://taxaudit.com.my/services/audit/0 Comments 0 Shares - Essential Aspects to Assess Post Tax Audit for Optimal Compliance

Post tax audit assessments should focus on identifying discrepancies, ensuring documentation accuracy, reviewing compliance with current tax laws, and implementing corrective actions. Regular updates to accounting practices, thorough internal reviews, and training for staff on tax regulations are crucial for maintaining optimal compliance and minimizing future audit risks.

For More Info Visit: https://www.thenewsbrick.com/essential-aspects-to-assess-post-tax-audit-for-optimal-complianceEssential Aspects to Assess Post Tax Audit for Optimal Compliance Post tax audit assessments should focus on identifying discrepancies, ensuring documentation accuracy, reviewing compliance with current tax laws, and implementing corrective actions. Regular updates to accounting practices, thorough internal reviews, and training for staff on tax regulations are crucial for maintaining optimal compliance and minimizing future audit risks. For More Info Visit: https://www.thenewsbrick.com/essential-aspects-to-assess-post-tax-audit-for-optimal-compliance0 Comments 0 Shares - Top 10 Accounting Firm Services Ideal for Outsourcing

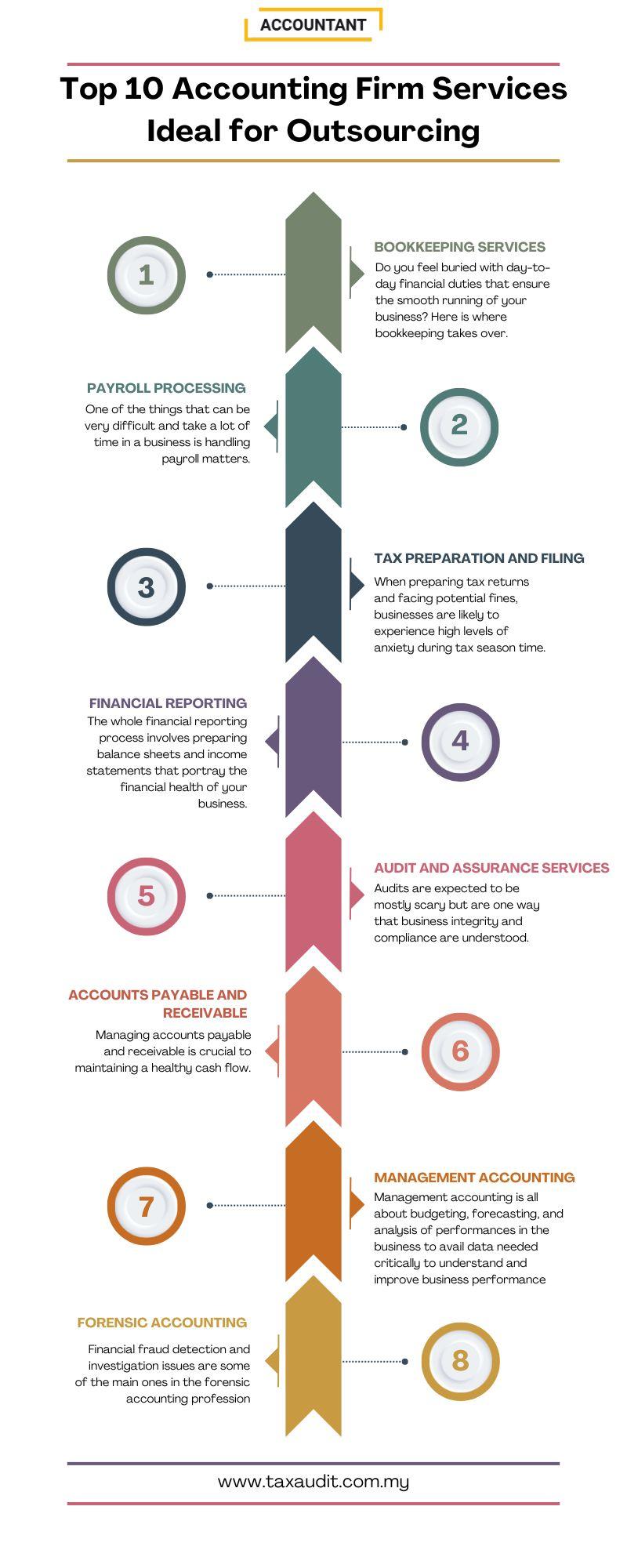

Outsourcing accounting firm services like payroll processing, tax preparation, bookkeeping, financial reporting, audit support, accounts payable/receivable, compliance management, budgeting and forecasting, CFO advisory, and forensic accounting enhances efficiency, ensures accuracy, and allows businesses to focus on core operations while leveraging expert knowledge and advanced technology.

For More Info Visit: https://www.topcloudbusiness.com/top-10-accounting-firm-services-ideal-for-outsourcing/Top 10 Accounting Firm Services Ideal for Outsourcing Outsourcing accounting firm services like payroll processing, tax preparation, bookkeeping, financial reporting, audit support, accounts payable/receivable, compliance management, budgeting and forecasting, CFO advisory, and forensic accounting enhances efficiency, ensures accuracy, and allows businesses to focus on core operations while leveraging expert knowledge and advanced technology. For More Info Visit: https://www.topcloudbusiness.com/top-10-accounting-firm-services-ideal-for-outsourcing/0 Comments 0 Shares - Advantages of Payroll Outsourcing Services for Your Practice

Outsourcing your payroll services can streamline operations, freeing up time for core business activities. It ensures compliance with ever-changing regulations, reduces errors, and enhances data security. Access to expert knowledge improves accuracy and efficiency. Scalability allows for seamless adaptation to business growth. Ultimately, it optimizes cost-effectiveness and boosts productivity.

For More Info Visit: https://www.instantinkhub.in/advantages-of-payroll-outsourcing-services-for-your-practice/Advantages of Payroll Outsourcing Services for Your Practice Outsourcing your payroll services can streamline operations, freeing up time for core business activities. It ensures compliance with ever-changing regulations, reduces errors, and enhances data security. Access to expert knowledge improves accuracy and efficiency. Scalability allows for seamless adaptation to business growth. Ultimately, it optimizes cost-effectiveness and boosts productivity. For More Info Visit: https://www.instantinkhub.in/advantages-of-payroll-outsourcing-services-for-your-practice/0 Comments 0 Shares - Top Reasons Your Business Should Partner with Payroll Service Companies

Partnering with payroll service companies streamlines your business operations. They ensure accurate and timely payroll processing, compliance with tax regulations, and reduced risks of errors. By outsourcing payroll, you save time, resources, and mitigate potential penalties. Trusting experts allows you to focus on core business activities while ensuring payroll efficiency and compliance.

For More Info Visit: https://www.freeflowwrites.in/top-reasons-your-business-should-partner-with-payroll-service-companies/Top Reasons Your Business Should Partner with Payroll Service Companies Partnering with payroll service companies streamlines your business operations. They ensure accurate and timely payroll processing, compliance with tax regulations, and reduced risks of errors. By outsourcing payroll, you save time, resources, and mitigate potential penalties. Trusting experts allows you to focus on core business activities while ensuring payroll efficiency and compliance. For More Info Visit: https://www.freeflowwrites.in/top-reasons-your-business-should-partner-with-payroll-service-companies/0 Comments 0 Shares - Essential Elements to Assess Post-Tax Audit Process

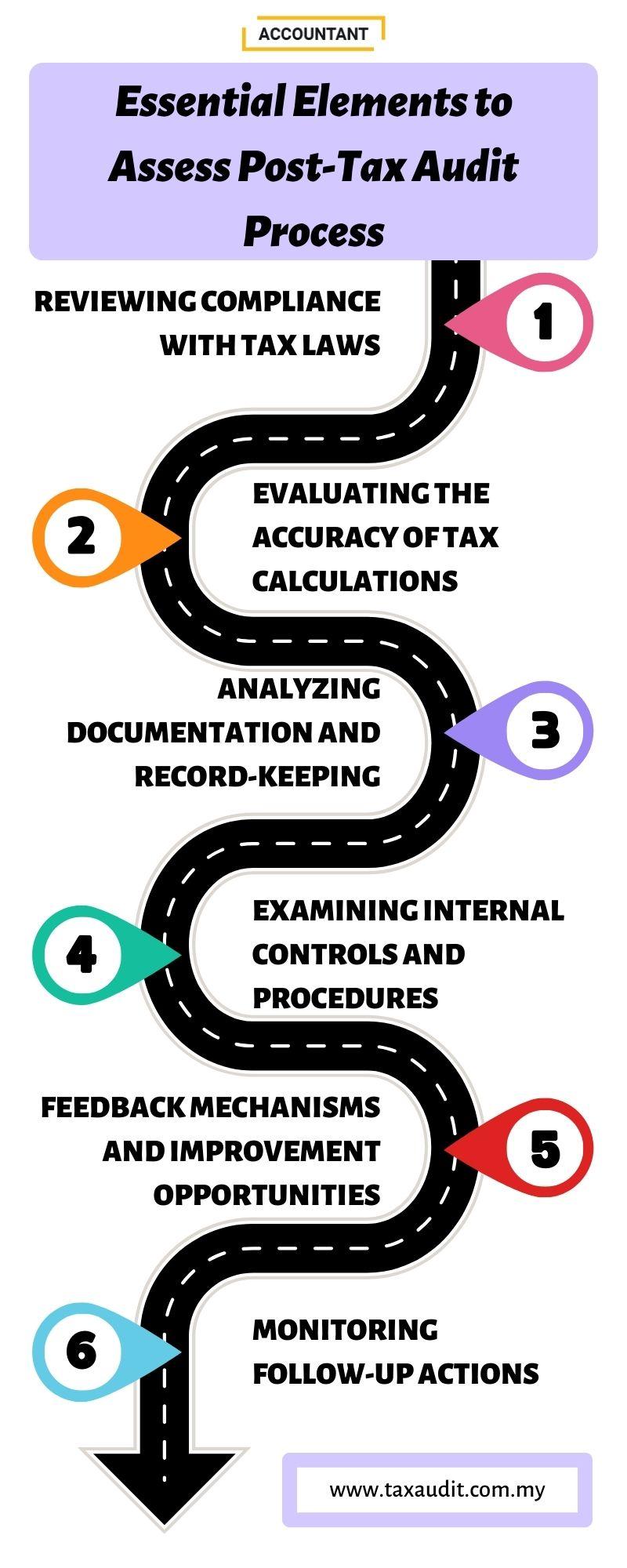

After a tax audit, certain elements are crucial to assess. Review documentation accuracy, compliance with tax laws, and potential errors. Analyze communication with auditors, ensuring clarity and professionalism. Evaluate any penalties or adjustments and their impact. Seek professional guidance to understand audit outcomes and implement necessary changes for future compliance.

For More Info Visit: https://dailynewsupdate247.in/essential-elements-to-assess-post-tax-audit-processEssential Elements to Assess Post-Tax Audit Process After a tax audit, certain elements are crucial to assess. Review documentation accuracy, compliance with tax laws, and potential errors. Analyze communication with auditors, ensuring clarity and professionalism. Evaluate any penalties or adjustments and their impact. Seek professional guidance to understand audit outcomes and implement necessary changes for future compliance. For More Info Visit: https://dailynewsupdate247.in/essential-elements-to-assess-post-tax-audit-process0 Comments 0 Shares - Register New Company and Ignite Growth: Essential Steps Unveiled

Ignite growth by registering a new company with these essential steps unveiled. From selecting a business structure to legal requirements, this guide ensures a smooth startup process. Set the foundation for success, navigate regulations, and embark on your entrepreneurial journey with confidence. Elevate your business dreams by laying a solid groundwork for future growth.

For More Info Visit: https://blogrism.com/register-new-company-and-ignite-growth-essential-steps/Register New Company and Ignite Growth: Essential Steps Unveiled Ignite growth by registering a new company with these essential steps unveiled. From selecting a business structure to legal requirements, this guide ensures a smooth startup process. Set the foundation for success, navigate regulations, and embark on your entrepreneurial journey with confidence. Elevate your business dreams by laying a solid groundwork for future growth. For More Info Visit: https://blogrism.com/register-new-company-and-ignite-growth-essential-steps/0 Comments 0 Shares

More Stories